At October 18, 2017. the Ministry of Finance officially submitted the Opinion, confirming that the confirmations of residence for Google and Facebook can be issued in electronic form and that they are fully valid in this form. This method of issuing confirmations is also important for companies which deals with digital business, because their headquarters are in Ireland, but also for domestic firms.

Confirmations must be translated and certified on a special form prescribed by the competent authority of the State with which it has concluded an Agreement on avoidance of double taxation. A confirmation of residence is issued by the competent authority of the State for which it is required. It is required for all companies that provide foreign services in our country, with which Serbia has signed this Agreement.

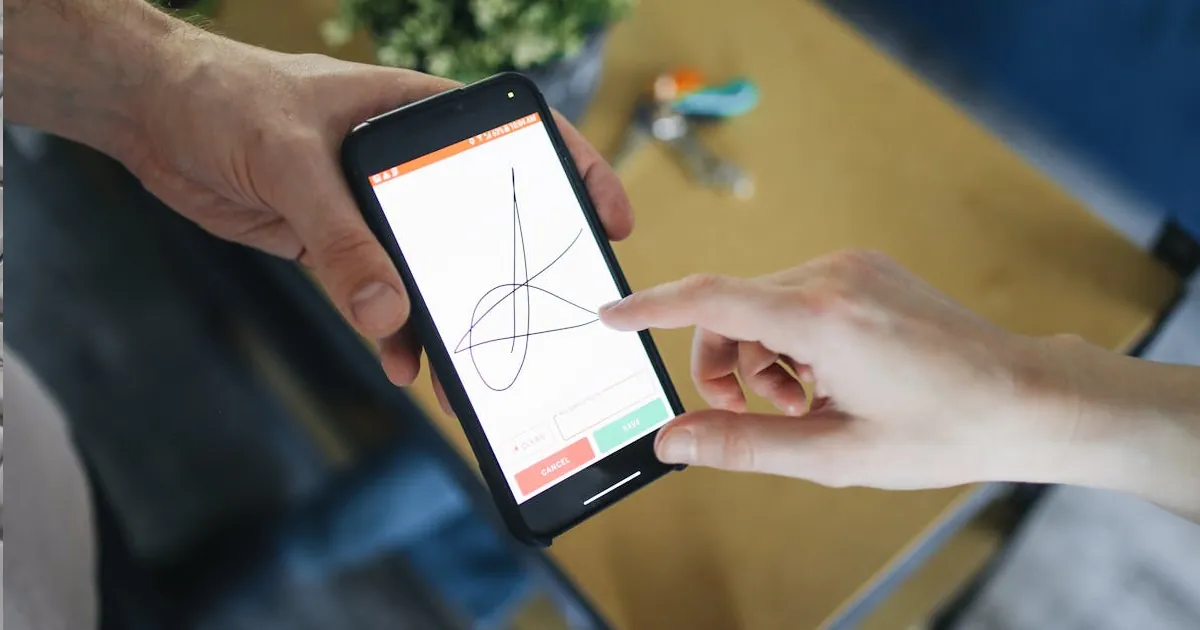

Confirmations of residence in electronic form solve double taxation situations, but also shorten the waiting time of the paper originals, once the only possible solution.

The Republic of Ireland has sent an official announcement that after the changes of procedures, in 2017, the process of issuing confirmations of residence in electronic PDF format began in that country. The notice that has arrived resolves the problem of double taxation, confirms the residence of foreign companies and proves that they are registered and taxed in Ireland.

Serbia and the Republic of Ireland have concluded this Agreement, which shall apply from 01.01.2011. years. A residence confirmation is important because it proves the status of a resident of the state with which the Agreement on avoidance of double taxation has been concluded, which must be certified in the competent court.

Confirmation of residence exempt from tax deduction

If you are a company advertised on the Internet, you are required to pay a deduction tax. The residence confirmation in this situation exempts you from paying this tax for services performed in the current year. The deduction tax is 20%.

The tax is paid on income that non-resident legal entities (Facebook, Google …) are derived from residents, or domestic legal entities.

Facebook and Google are foreign platforms that in Serbia are mostly engaged in advertising services. This also applies to advertising services on other social networks, search engines or on any other international Internet advertising platform.

To whom is the confirmation of residence submitted and how to get exemption from tax deduction?

The confirmation of residence of a foreign company – non-resident, to whom the advertising services are paid, is submitted to the Tax Administration of the Republic of Serbia.

Exemption from payment of this tax is realized only if the validity of the confirmation of residence of that foreign legal entity is submitted to the Tax Administration. In order for an electronic confirmation to be valid in Serbia, it must first be translated and then certified by an authorized court interpreter, in paper form. Each confirmation must be translated and certified in particular.

This rule applies to all foreign companies providing advertising services with headquarters or representative offices in countries with which Serbia has a Agreement on avoidance of double taxation.

How to obtain confirmation of residence?

Foreign companies that have their representative offices in Ireland may be contact by requesting customer support. But, companies in countries with which Serbia has a signed Agreement can also be contacted, which provide services in the territory of Serbia. The prescribed confirmation form is received electronically in PDF form within two days.

The received electronic confirmations of residence apply only in the current year, ie they are not valid for the previous period.